Target’s Brian Cornell vows price hikes remain a last resort, even as Trump’s tariff plans intensify pressure.

Target price hikes are the rumor you hope to ignore but can’t shake. Shoppers feel the ground tilt with each headline about tariffs and jittery supply chains. Walmart hints at higher tags; Target whispers restraint. Let’s unpack what that really means for your cart and your weeknight budget.

Why target price hikes

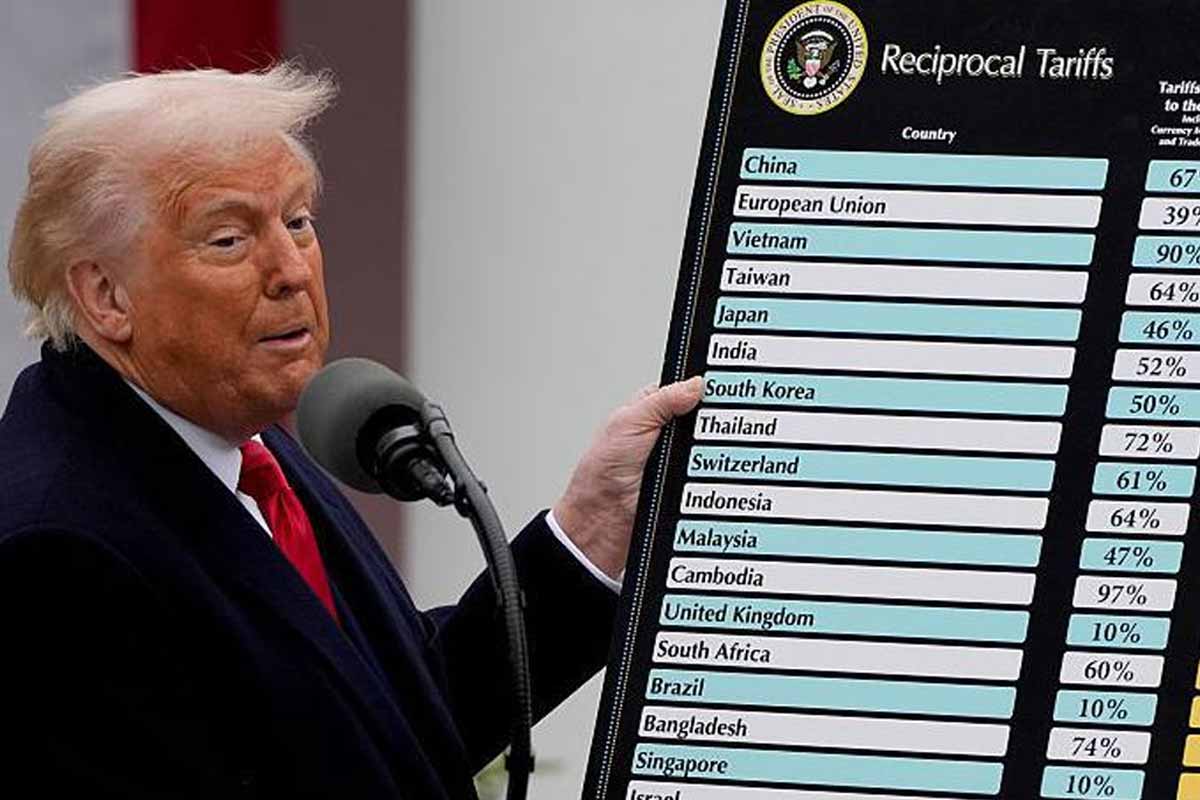

Target says price increases are the last stop, not the first. Brian Cornell repeated that line to investors, steady and clear. The message lands during a noisy fight over retail pricing. Walmart warned shoppers about rising tags and caught heat online. Trump blasted those warnings in public, and the clip traveled fast. Business leaders took note, because politics now sits inside pricing. Target price hikes remain a possibility, but management frames them as rare. That framing sets Target apart in a crowded field of caution. It also buys time while the dust from tariffs keeps swirling. Everything traces back to Trump’s tariff agenda, which scrambles costs across categories.

Investors see the squeeze in guidance, and shoppers feel it at checkout. Both sides watch the next move with a raised eyebrow. Shoppers read that stance as a promise and a challenge. Hold the line, even when freight, fuel, and parts get jumpy. Analysts are split on the odds, which keeps the rumor mill busy. Social feeds fill with receipts, and the discourse turns spicy.

Retail on a tightrope

The retail floor shakes when policy shifts hit at speed. Home Depot, Lowe’s, and Mattel juggle margins without spooking loyal customers. Producers whisper about price adjustments, then test the market with tiny steps.

Small businesses carry the heaviest pack, with thinner buffers and fewer levers. Trade groups warn that closures follow when costs outrun cash. Target tries to thread the needle while the sector recalibrates. Target price hikes would ripple beyond one chain, setting a tone for rivals. That backdrop explains the careful language from every earnings call. Trump’s tariff agenda adds volatility, week after week, headline after headline.

Shoppers hear all of it and plan fewer impulse buys. Suppliers renegotiate lead times, and trucks idle longer at ports. Currency swings add tiny costs that stack like poker chips. Some brands shrink packages rather than touch the shelf tag. Others test regional pricing, hoping shoppers won’t compare notes. Everyone is watching loyalty data like hawks on a wire.

Discounts, trust, and the long game

Target fights sticker shock with old-school moves: rollbacks and coupons that actually matter.

More than five thousand everyday items sit on markdown to cushion wallets. That choice protects trust, the brand’s most fragile asset right now.

Sales lagged this quarter, and guidance dipped, yet the promise stands. Keep shelves full, keep prices steady, and keep the vibe calm. Target price hikes stay parked while discounts carry the load. It’s a delicate strategy, because margin math rarely forgives loyalty plays. Trump’s tariff agenda keeps raising the waterline underneath those plans. Customers don’t need a memo; they read the aisles like tea leaves.

Hold the line long enough, and habit can beat headlines. Store teams rework endcaps to spotlight essentials people buy weekly. Price signs get cleaner, brighter, and more direct about savings. Clear math builds confidence when news cycles churn like stormwater. Customer service scripts include empathetic lines for tough conversations. The aim is simple: keep carts rolling without sticker shock.

Rerouting the supply chain

Target rebuilt its map for sourcing, and the pins keep moving. Less reliance on China, more orders placed in the States and elsewhere. Leaders say roughly half the mix already comes from outside China. The shift blunts direct hits from steep import levies. Plants closer to customers speed deliveries and tame freight surprises. Target price hikes get harder to justify when logistics stop misbehaving. Suppliers adjust runs, and contracts now include flexible clauses for shocks. The company wants more labels that read “Made in USA.” Lower transit risk meets hometown pride, and that combination sells. The approach won’t erase every cost spike, but it helps.

Geopolitics now sits in every purchase order, plain as day. Alternative suppliers mean fresh vetting and tighter quality checks. Legal teams rewrite clauses about delays, quotas, and strikes. Finance models new risks, from port closures to sudden surcharges. Operations leaders sleep with phones beside the bed, just in case.

What shoppers should expect next

Shoppers keep spending, even as confidence walks with a limp. Retail growth barely budged last month, and wallets feel thinner. Holiday seasons amplify every decision, from endcaps to unit costs. Expect sharper promotions and fewer wild markdowns on premium brands. Target price hikes could appear in pockets, tied to tight categories.

Watch paper goods, imported snacks, and certain small appliances. Subscribe and save where it helps, and time bigger buys around sales. Store brands will keep earning trust as national labels inch upward. Trump’s tariff agenda remains the storm front shaping these forecasts. If policy eases, the pressure dial loosens; if not, brace. Either way, clear communication matters more than clever spin. Tell shoppers what changed, and show receipts when choices sting. We’ll learn quickly whether restraint becomes a durable advantage.

For now, the aisle whisper says patience beats panic. And your budget will thank you for every calm, boring cart. Look for clearer tags that explain when a hike connects to duties. Transparency dulls frustration, even when the bill nudges upward. Community programs and local hiring can soften hard headlines. Brands that show up during stress earn forgiveness later. Keep receipts, track trends, and celebrate small wins at checkout. The goal isn’t perfection; it’s control over the few levers you hold.